BlueSkyMint has quickly gained attention as a promising new player in the world of online investment platforms. With its user-friendly interface and diverse range of investment options, it aims to bridge the gap between traditional finance and the evolving digital trading space.

This BlueSkyMint.com review examines a trading platform that entered the market just over a year ago with a mission to make investing more transparent and accessible. The platform caters to both newcomers and experienced traders through its tiered account structure and multi-asset offerings.

Account Tier Breakdown

BlueSkyMint structures its accounts across six distinct levels, each offering progressively more features and benefits. The entry point starts at $10,000, which is higher than some competitors but comes with specific advantages at each tier.

The Bronze account ($10,000) serves as the starting point. Users get access to leverage up to 1:10, the Trading Academy, weekly market reviews, a dedicated account manager, and weekly portfolio reports. This foundation gives new traders the basics they need without overwhelming them with too many options.

Silver tier ($25,000) adds a personal portfolio manager and weekly analyst sessions on top of everything Bronze offers. These additions mean users get more personalized attention and regular professional insights into their trading activity.

A key point in this BlueSkyMint.com review is how the Gold level ($50,000) represents a significant jump in features. Leverage increases to 1:50, which amplifies both potential gains and risks.

Daily analyst sessions replace weekly ones. Live weekly webinars, custom trader education, daily market signals, VIP event access, and a 25% swap discount all come standard. The swap discount particularly benefits traders who hold positions overnight.

Platinum ($100,000) keeps all Gold features and adds monthly accountant sessions, 24/7 account monitoring, and annual summaries. The accountant sessions help traders understand the tax implications of their trading activity. The annual summary provides a comprehensive breakdown of yearly performance.

Diamond tier ($250,000) matches Platinum features but signals a higher commitment level. The main difference lies in the priority treatment and attention from the support team. Diamond users often receive faster response times and more in-depth analysis during their sessions.

It must be noted in this BlueSkyMint.com review that the VIP account ($500,000) operates differently from all other tiers. Everything becomes customizable. Spreads start from 0.001 pips with no commissions.

The account runs swap-free, eliminating overnight holding costs entirely. Access expands to include over 100 currency pairs, more than 600 CFD pairs, ETFs, IPOs, and ICOs. This level essentially creates a personalized trading environment.

Trading Assets Offered

The platform provides access to six main asset categories, giving traders multiple ways to build their portfolios. Each category behaves differently under various market conditions, which helps with risk management.

Cryptocurrency trading includes major players like Bitcoin and Ethereum. These digital assets operate 24/7, unlike traditional markets. Price movements can be substantial, making them attractive for traders comfortable with volatility.

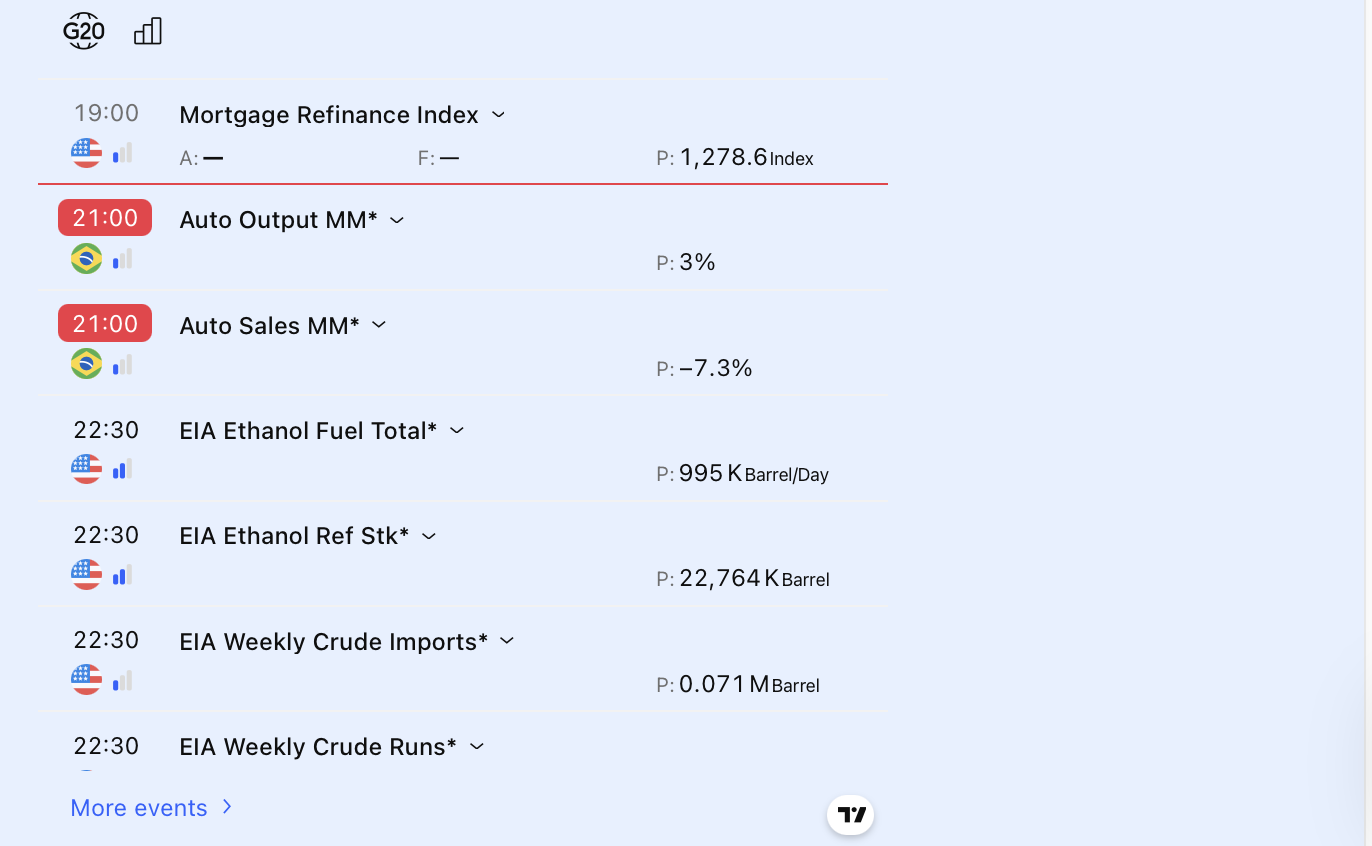

Forex currency pairs make up a large portion of available trades. In this BlueSkyMint.com review, it’s clear that major pairs like EUR/USD and GBP/USD get the most attention, but the platform also offers minor and exotic pairs. Currency markets react to economic data, central bank decisions, and geopolitical events.

Another point to highlight in this BlueSkyMint.com review is the index trading capability. Instead of picking individual stocks, traders can take positions on entire market segments. The S&P 500 represents 500 large U.S. companies. The NASDAQ focuses on technology stocks. Other global indices like the FTSE 100 or DAX provide exposure to European markets.

Commodity markets cover physical goods that power the global economy. Oil prices respond to supply disruptions and demand forecasts. Agricultural products like wheat and coffee fluctuate with weather patterns and crop reports. These markets often move independently of stocks and currencies.

Precious metals, particularly gold and silver, serve multiple purposes in a portfolio. Gold often acts as a haven during market uncertainty. Silver has both investment demand and industrial uses.

Share trading allows direct ownership of portions of individual companies. This differs from index trading by focusing on specific business performance rather than broad market trends.

Advanced Analytics Capabilities

BlueSkyMint equips traders with professional-grade analytical tools typically found on institutional platforms. These aren’t simplified versions for retail users but actual functional tools that serious traders rely on daily.

Chart analysis features include multiple timeframes, from one-minute charts for day traders to monthly charts for long-term position traders. Technical indicators like moving averages, RSI, MACD, and Bollinger Bands come standard. Traders can overlay multiple indicators to develop complex strategies and test how different setups would have performed historically.

Risk management options extend beyond simple stop-loss orders. The platform supports trailing stops that automatically adjust as trades move into profit. This locks in gains while giving positions room to run. Take-profit orders automatically close winning trades at predetermined levels, removing emotion from the equation.

As can be seen in this BlueSkyMint.com review, the trade timing assistance helps users identify potential entry and exit points. The system analyzes price patterns, volume, and momentum to highlight situations where historical patterns suggest possible moves. These aren’t predictions but rather observations about similar past scenarios.

The analytics package also includes correlation analysis, showing how different assets move in relation to each other. A trader holding multiple positions can see if they’re actually diversified or if all their trades essentially bet on the same outcome. True diversification means holding assets that don’t all move together.

Funding Your Journey

Getting money into and out of a BlueSkyMint account follows a straightforward process, though the specifics matter for planning trades and managing cash flow.

Deposit procedures start with selecting a payment method from the available options. The platform processes deposits through secure channels, and funds typically appear in trading accounts within a set timeframe. Bank transfers take longer than card payments, but often work better for larger amounts.

A few more insights in this BlueSkyMint.com review include how withdrawal requests get handled. Users submit withdrawal requests through their account dashboard. The platform reviews each request for security purposes before processing. Funds return through the same method used for deposit when possible.

Transaction speed varies by method and amount. Smaller withdrawals often process faster than large ones. Payment security uses encryption and verification at multiple points. Each transaction requires authentication, and the platform monitors for unusual patterns.

Transparency and Communication

BlueSkyMint operates with an open approach to information sharing. The platform makes pricing structures visible upfront rather than hiding costs in fine print. Users can see spreads, swap rates, and any other fees before placing trades.

The pricing structure varies by account tier and asset type. Higher-tier accounts generally get better rates, which makes sense given their larger deposits. The platform displays current spreads in real time so traders can factor costs into their decisions.

It’s worth emphasizing in this BlueSkyMint.com review that the operational approach focuses on clarity. When the platform makes changes to features, fees, or available assets, users receive notifications.

Risk disclosure appears prominently throughout the site. The platform clearly states that leveraged trading carries substantial risk and many traders lose money. This honesty about potential downsides actually builds credibility rather than scaring people away.

FAQs

What assets can be traded?

The platform offers cryptocurrencies, forex pairs, indices, commodities, precious metals, and individual company shares. Over 160 different assets are available across these categories.

How quickly can funds be accessed?

Withdrawal processing times depend on the method and amount. Smaller withdrawals typically process faster. The platform reviews each request for security before releasing funds.

What support is available?

BlueSkyMint provides 24/7 customer support. Account managers get assigned at all tier levels. Higher tiers receive additional support through portfolio managers, analyst sessions, and accountant consultations.

Is the platform suitable for beginners?

The Bronze tier includes educational resources like the Trading Academy and weekly market reviews. New traders get a dedicated account manager to help them learn. However, the $10,000 minimum deposit is substantial for someone just starting.

Final Thoughts

This BlueSkyMint.com review wraps up by noting the platform’s structured approach to serving different trader levels. The tiered system lets users access more features as their accounts grow, from basic Bronze benefits to fully customized VIP experiences.

The combination of multiple asset classes, professional-grade analytical tools, and educational support creates an environment where traders can develop their skills while managing real positions. The platform’s transparent pricing and clear risk disclosures show a commitment to honest communication. For those prepared to meet the minimum deposit requirements, BlueSkyMint offers a comprehensive trading solution with room to grow.